Q3 Lookback: Bitcoin Transaction Fees & Hashrate Index’s Weekly Forecasts

For the past twenty weeks, Hashrate Index has provided forecasts for Bitcoin transaction fees in our Weekly Roundup newsletter. With Q3 2024 now over, it’s time to look back, see how we did, and discuss important takeaways about fees going forward.

What Happened to Fees in Q3?

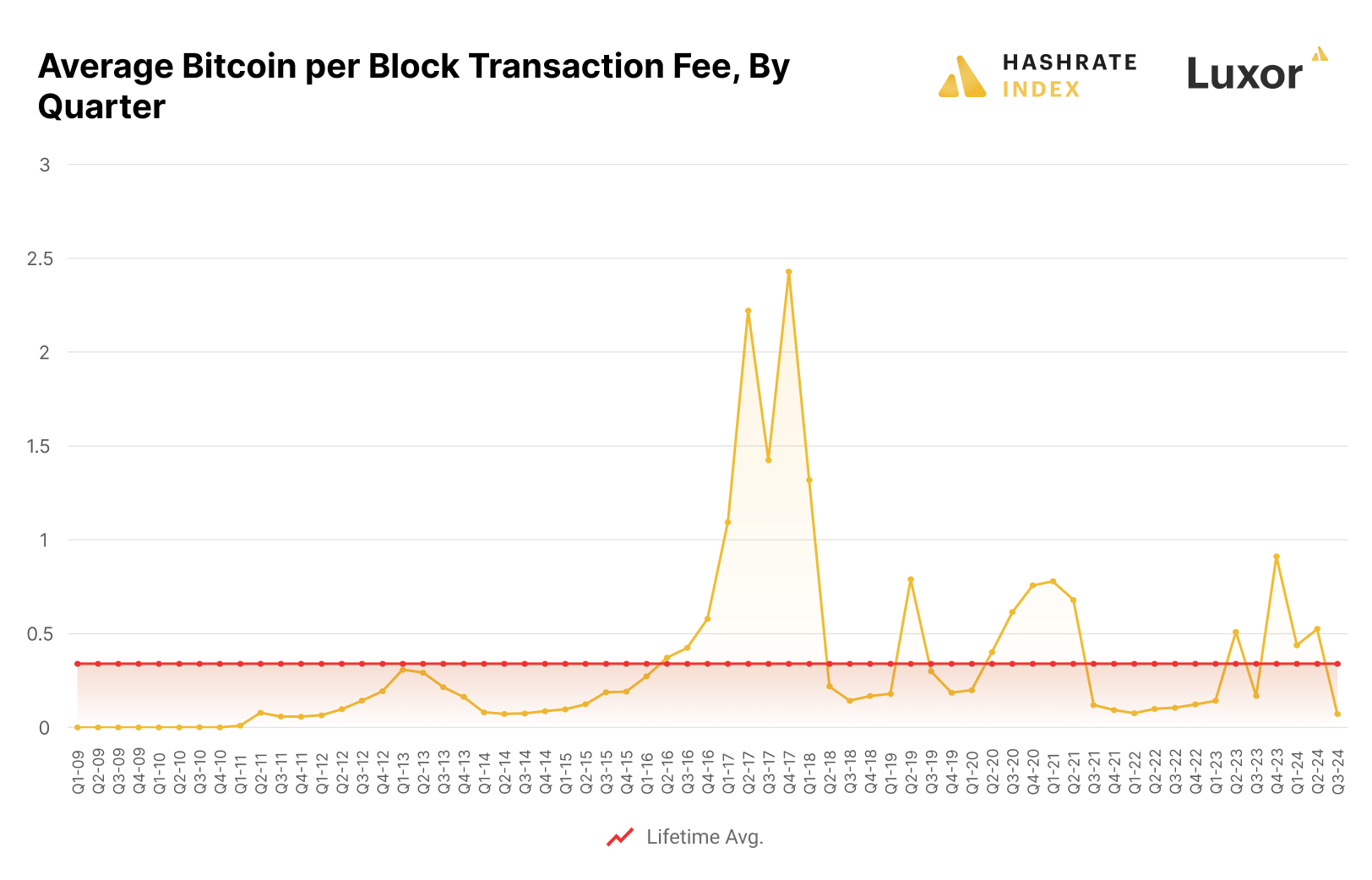

After a period of post-halving volatility, Bitcoin transaction fees hit some pretty shocking lows in Q3 2024. As BRC-20, Ordinals and Runes activity subsided, average transaction fees per block (on a Bitcoin denominated basis) were lower than any quarter since Q2 2014. In fact, Q3 2024’s average fees per block of 0.073 BTC is approximately 80% lower than the lifetime average figure of 0.34 BTC per block since Bitcoin’s inception.

The steep drop in fees wasn’t anticipated by markets. In Q2, Luxor’s Hashrate Forward Market was pricing Q3 hashrate above where it actually settled. Of course, higher-than-expected hashrate growth during Q3 was a contributing factor but lower-than-expected fees exacerbated the mismatch as hashprice settled below expectations.

How Did Hashrate Index’s Weekly Forecasts Perform?

Hashrate Index’s weekly forecast models provided some valuable information about transaction fees during Q3 2024. For those interested in obtaining a detailed understanding of our model construction and interpretation, please see our previous research paper New Methods for Forecasting Bitcoin Transaction Fees.

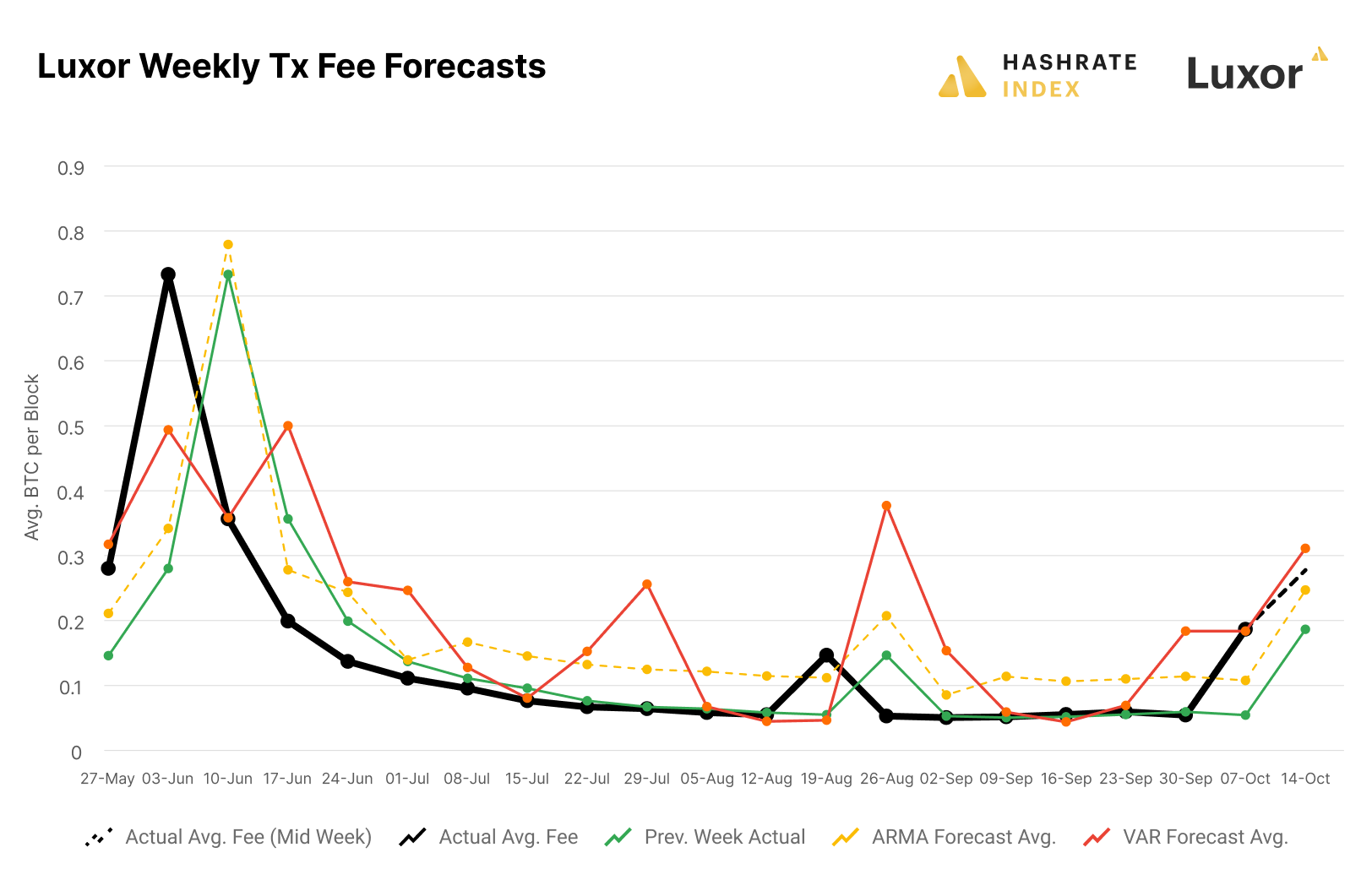

ARMA forecasts use past values and past errors of a univariate time series to predict future values. As expected, the ARMA forecasts struggled to capture sudden spikes in fees and tended to overcompensate after those spikes. As volatility subsides, ARMA models return to long-term averages.

Interestingly, during low volatility throughout Q3 2024, our ARMA model consistently overestimated transaction fees. Since the model was specified using data back to 2017, this suggests that something is now structurally different about fees and Bitcoin’s blockspace market. Perhaps traditional Bitcoin users became more efficient at using L1 blockspace due to periodically high fees over the last 18 months, so when Ordinals/BRC-20/Runes activity subsided, fees fell to a lower than anticipated floor. This is one of many potential hypotheses which deserve further investigation. Moving forward, we’ll be running the ARMA model on more recent data to account for the structural change.

Also as expected, our VAR model was a useful leading indicator of upcoming transaction fee spikes. VAR forecasts model multiple time series simultaneously, using the past values of all series in the system to predict future values, capturing interdependencies among the variables for more comprehensive forecasts. Our VAR models considers publicly available information such as on-chain data, mempool data and exchange activity.

The VAR forecast successfully predicted the late May / early June and October spikes in transaction fees, and outperformed the ARMA in detecting the bearish action between those spikes. It produced three false alarms: June 17, July 22-29, and August 26 - September 2. However, the last of those false alarms was due to a pre-announced one-off event (Babylon); we did not expect the model to pick this up ahead of time but we did expect it to overcompensate for the spike afterwards. In the other two instances, VAR false alarms were contradicted by the ARMA forecast.

What Are Some Important Takeaways?

The real value in forecasting an unknowable time series such as Bitcoin transaction fees comes from understanding the structure of different models and the underlying data. As we would expect, our models underperformed previous week actuals during a period of low volatility. However, the VAR model has demonstrated, yet again, its value as an imperfect leading indicator for rising fees.

For Bitcoin miners, hosters, lenders, hashrate traders, and financial markets participants, using and understanding both quantitative and qualitative methods to plan for the future across a range of plausible scenarios is critical. Hashrate Index’s publicly available forecasts can serve as one third-party source of information in the forward planning and decision making process. If you would like more detailed and long term transaction fee, hashrate, difficulty, and hashprice projections, we recommend checking out our Hashrate Index Premium offering.

But ultimately, future transaction fees are unknowable and fluctuate due to unforeseen circumstances. If your core business does not involve speculating on Bitcoin transaction fees, we recommend considering Luxor’s Hashrate Forward Market as a method for removing exposure to this risk from your mining operations. Much like in traditional commodities, forward markets enable hashrate producers to trade risk exposure with speculators and focus on what they do best.

Looking forward, for the first time in 18 weeks we have reason to believe that transaction fees are sustainably rebounding from historic lows. Our quantitative models are projecting moderate volatility in the more typical range of fees. Anecdotally, we are seeing a moderate resurgence of interest in Runes, and qualitatively, we know this spike is different from the one-off Babylon episode in August.

Anything can happen in the future but hopefully, for the sake of Bitcoin mining revenue, our indicators are correct and the worst of the transaction fee bear market is behind us.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.