Looking Over the Hashprice Cliff

Why It May Be a Good Time For Bitcoin Miners to Consider Hedging

By Dan Rosen

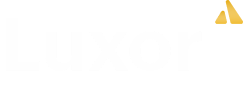

In the last month, we saw hashprice decline after the early- to mid-May transaction fee spike, settling around $65.50 today. This current spot price reflects a drop of approximately 16% in the last 30 days - partially due to a normalization in transaction fees and increase in network difficulty and in part due to the drop in Bitcoin price by 2.5% during the same time frame.

While some Bitcoin mining hedgers may be weary of selling hashprice at these more recent lows, it is important to place this current hashprice in the context of recent history. On Jan 1 of this year, Bitcoin price sat at ~$16,615. While it rallied to hit YTD highs above $30k, we now sit almost 12% off those YTD highs at $26,415 (as of the time of publishing).

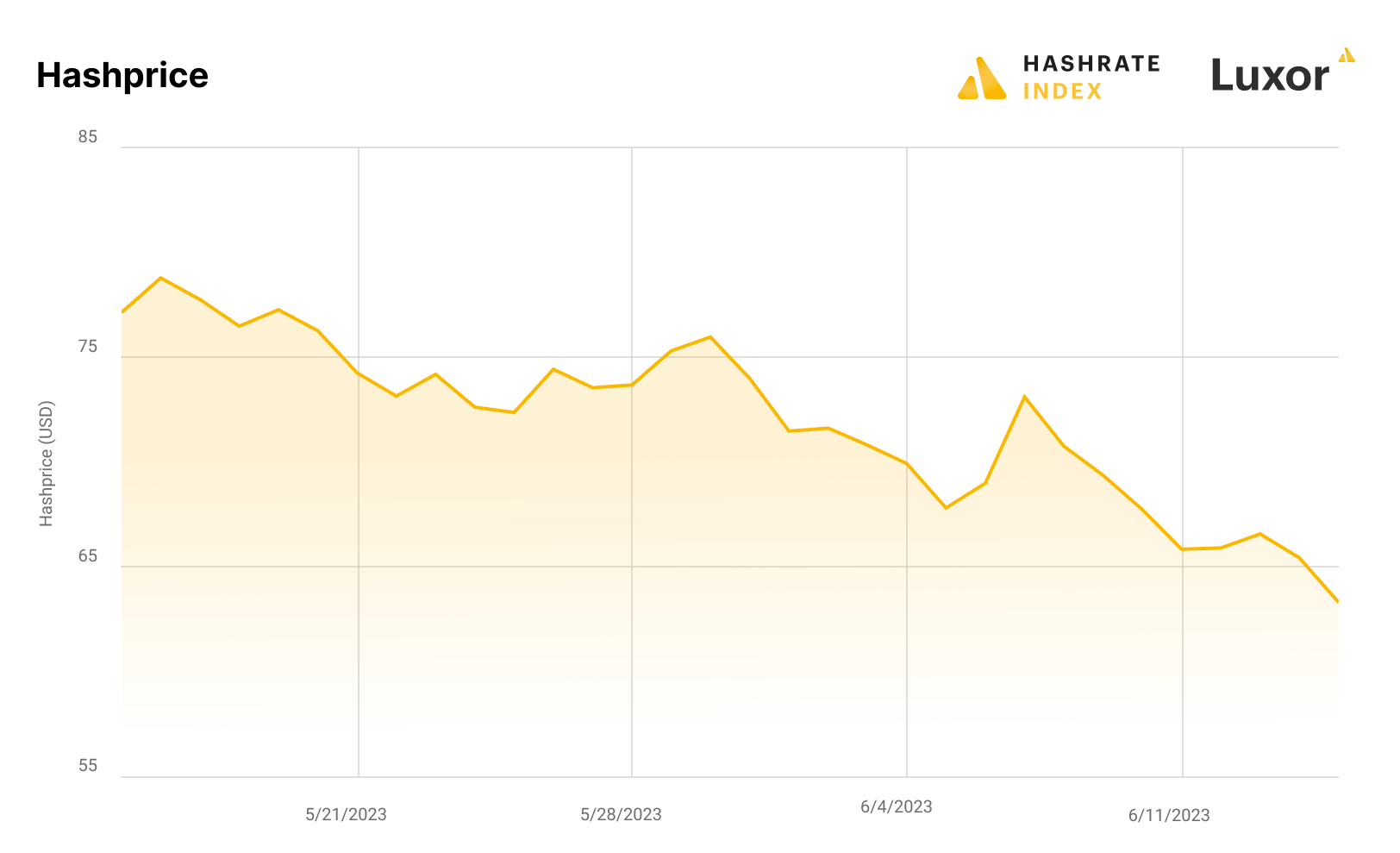

More importantly, network difficulty has continued its steady climb to 52.35T as of the latest adjustment. We have seen only 3 downward adjustments since the start of the year when difficulty started at 35.36T while we have seen 10 upward adjustments. The decreases in difficulty have been dwarfed by the magnitude and frequency of the increases in difficulty, resulting in a 52.9% increase in difficulty in just 6.5 months. Network difficulty shows no signs of slowing down, as we are 10% through the the newest epoch and average block times remain below 10 minutes, clocking in at an average of 9 minutes and 41 seconds.

Hashprice of $65.50 may seem low, but this could be the new reality. Without even contemplating the halving on track for 10 months from now, it is critical for miners to look at their operations and ensure they are hedged for adverse scenarios. Assuming network difficulty remains close to this current level and transaction fees continue to hover somewhere around 0.30 BTC per block, let’s examine what hashprice looks like for changes in BTC price.

For a BTC price of $20k, hashprice falls to ~$50, which may be difficult for miners to stomach. However, if BTC price breaks back down to where we started the year (no matter how unlikely you may think that scenario is), we’re looking at a hashprice of ~$42. This could be a harsh reality, but it is a realistic scenario that has at least A PROBABILITY of occurring.

Fortunately, Luxor’s Hashprice Forwards are a great solution for locking in Hashprice for up to 90 days forward (and soon for 180 days!) and ensuring your operations can continue to operate profitably given adverse changes in Bitcoin price, network difficulty, or transaction fees. Reach out to derivatives@luxor.tech or visit luxor.tech/derivatives to learn more about how Luxor can help with these risks.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.